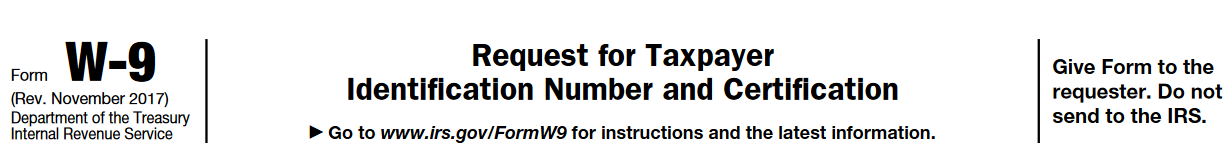

Each employer’s direct duty – to be acquainted with the notion of W-9 tax forms

According to the law demands, US hirers are required to acknowledge the work permit for all workers whom they employ from November 6, 1986, despite the immigration status of the last one. Employers who hire or keep staff, knowing that they do not have the right to work in the US, or do not meet the necessary requirements, violate civil law laws, and sometimes, criminal. Tax document w 9 should…