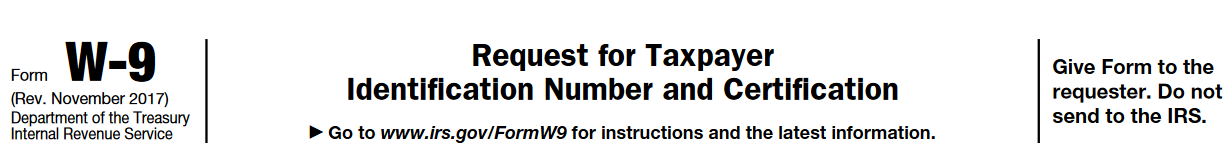

An independent contractor or consultant is to fill out a W-9 once he/she signs a contract with a client. It’s a usual process to get ready for the tax year. The Internal Revenue Service demands to report every business interaction between a freelance worker and a company valued at $600 or more. You see, whenever a client hires an independent contractor, he must get their TIN through this document to be able to accomplish the 1099-MISC on its basis.

Correct Completion. Why Is It So Important

What is a W9 form used for, you already know. Now you should learn about the importance of its correct completion. A contractor must provide their entire name, business title, physical address and ZIP code, EIN or SSN. Once everything is inserted correctly, the document must be dated and signed.

Why Employers Need W-9 form 2020

All the data that the employer receives in this document is kept as reference and verification purposes. When filling out the 1099-MISC, they will insert the freelance worker’s TIN (the same as EIN or SSN) since the IRS demands this information to help avoid any confusion when identifying all the individual workers involved.

So, while completing W9 is mandatory, the paper itself is never delivered to the IRS.